10+ 1099 Tax Secrets To Save You Time

As the world of freelance work and independent contracting continues to grow, understanding the intricacies of 1099 tax forms becomes increasingly important for both individuals and businesses. The 1099 form series is used to report various types of income to the IRS, other than wages, salaries, and tips. For those who receive 1099 forms, navigating the tax landscape can be daunting, especially considering the complexity and ever-changing nature of tax laws. Here, we’ll delve into over 10 secrets to help you save time and potentially reduce your tax liability when dealing with 1099 tax forms.

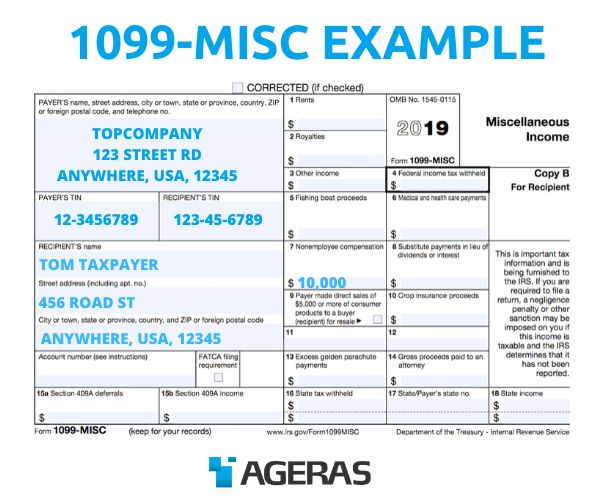

Understanding 1099 Forms

Before diving into the secrets, it’s essential to have a solid understanding of what 1099 forms are and how they work. The most common types include the 1099-MISC for miscellaneous income, 1099-INT for interest income, and 1099-DIV for dividend income. Each form serves as a record of income that must be reported on your tax return.

Secret 1: Keep Accurate Records

One of the most critical secrets to managing 1099 taxes efficiently is keeping accurate and detailed records. This includes all income received, business expenses, and any receipts that could be used as deductions. Utilizing a cloud-based accounting system can help in organizing your finances and ensure you’re ready when tax season arrives.

Secret 2: Understand Business Expense Deductions

For freelancers and independent contractors, deducting business expenses can significantly reduce taxable income. Understanding what qualifies as a business expense and keeping meticulous records can help maximize these deductions. This could include anything from home office expenses to travel costs related to your work.

Secret 3: Home Office Deduction

The home office deduction is a powerful tool for those who work from home. It allows you to deduct a portion of your rent or mortgage interest and utilities as a business expense. However, navigating the rules and ensuring you qualify can be complex. It’s often beneficial to consult with a tax professional to ensure you’re taking full advantage of this deduction without risking an audit.

Secret 4: Retirement Plan Contributions

Contributing to a retirement plan can not only save you for the future but also reduce your taxable income today. Freelancers and independent contractors have several options, including SEP-IRAs and solo 401(k) plans, which can provide significant tax benefits.

Secret 5: Quarterly Estimated Tax Payments

One of the challenges of being a 1099 earner is managing your tax payments throughout the year. The IRS requires quarterly estimated tax payments to avoid penalties. Understanding how to calculate these payments and staying on top of the due dates can help you avoid unnecessary fines and interest.

Secret 6: Health Insurance Deductions

For those who are self-employed, health insurance premiums can be deductible as a business expense. This can include premiums paid for yourself, your spouse, and your dependents. Keeping records of these payments can help reduce your taxable income.

Secret 7: Education Expenses

Investing in your professional development can be costly, but it may also be deductible. Courses, workshops, and even certain travel expenses related to your profession could qualify as business expenses. Keeping receipts and records of these expenses can help when it’s time to file your taxes.

Secret 8: Business Use of Your Car

If you use your car for business, you can deduct the business use percentage of your car expenses. This can include gas, maintenance, insurance, and even depreciation. Keeping a log of your business miles and expenses can help you maximize this deduction.

Secret 9: Hiring Family Members

For those with family members who help with their business, hiring them can provide tax benefits. Paying your children or spouse can reduce your taxable income and potentially lower your self-employment tax rate.

Secret 10: Professional Advice

Finally, one of the most valuable secrets is recognizing when to seek professional advice. Tax laws are complex and ever-changing, and a tax professional can provide personalized advice tailored to your specific situation. They can help you navigate the system, ensure compliance, and maximize your deductions.

Additional Tips

- Stay Organized: Implement a system for tracking income and expenses throughout the year.

- Educate Yourself: Continuously update your knowledge on tax laws and regulations affecting 1099 earners.

- Plan Ahead: Consider your tax situation throughout the year, not just during tax season.

FAQ Section

What is the deadline for filing 1099 forms with the IRS?

+The deadline for filing 1099 forms with the IRS is typically January 31st of each year. However, this deadline can vary depending on the specific form and whether you're filing electronically or by mail. It's essential to check the IRS website for the most current information.

How do I calculate my estimated tax payments as a 1099 earner?

+Calculating estimated tax payments involves estimating your tax liability for the year and dividing it by four. You can use Form 1040-ES to calculate and make these payments. It's recommended to consult with a tax professional to ensure you're making accurate calculations and avoiding underpayment penalties.

Can I deduct the cost of my home office if I work from home as a freelancer?

+Yes, if you use a dedicated space in your home regularly and exclusively for business, you may be able to deduct a portion of your rent or mortgage interest and utilities as a business expense. This is known as the home office deduction. There are two methods to calculate this deduction: the simplified option and the regular method. It's advisable to consult with a tax professional to determine which method is best for your situation and to ensure you're taking full advantage of this deduction.

In conclusion, managing 1099 taxes requires a strategic approach that includes understanding the forms, keeping accurate records, maximizing deductions, and potentially seeking professional advice. By leveraging these secrets and staying informed about tax laws and regulations, you can save time, reduce your tax liability, and focus on what matters most - growing your business or freelance career.