2024 1099 Deadline

As the tax season approaches, it’s essential for freelancers, independent contractors, and small business owners to stay on top of their financial obligations. One crucial deadline to keep in mind is the 1099 deadline for the 2024 tax year. In this article, we’ll delve into the world of 1099 forms, exploring what they are, who needs to file them, and the key deadlines to be aware of.

What is a 1099 Form?

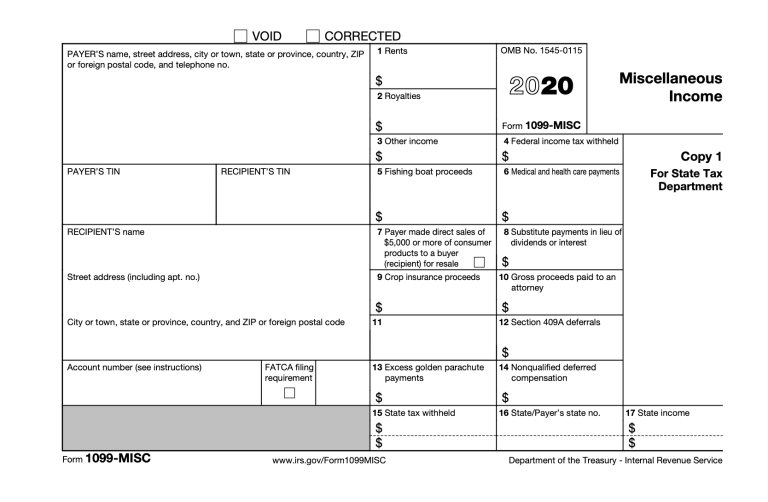

A 1099 form is a type of informational return used by the Internal Revenue Service (IRS) to report various types of income, such as freelance work, independent contracting, and self-employment. The most common types of 1099 forms include:

- 1099-MISC: Used to report miscellaneous income, such as freelance work, rents, and royalties.

- 1099-K: Used to report payment card and third-party network transactions, such as credit card payments and online sales.

- 1099-INT: Used to report interest income, such as dividends and interest on savings accounts.

- 1099-DIV: Used to report dividend income.

Who Needs to File a 1099 Form?

If you’re a freelancer, independent contractor, or small business owner, you’ll need to file a 1099 form if you’ve earned income from the following sources:

- Freelance work: If you’ve earned more than $600 from a single client, you’ll receive a 1099-MISC form from that client.

- Independent contracting: If you’ve worked as an independent contractor and earned more than $600 from a single client, you’ll receive a 1099-MISC form from that client.

- Self-employment: If you’re self-employed and have earned net earnings from self-employment of $400 or more, you’ll need to file a 1099-MISC form.

- Rent and royalty income: If you’ve earned rent or royalty income, you’ll need to file a 1099-MISC form.

2024 1099 Deadline

The deadline for filing 1099 forms for the 2024 tax year is January 31, 2025. This deadline applies to both the recipient and the payer of the income. As a recipient of income, you’ll need to receive your 1099 forms by January 31, 2025, to ensure you have enough time to file your tax return. As a payer of income, you’ll need to file your 1099 forms with the IRS and provide copies to the recipients by January 31, 2025.

Consequences of Missing the Deadline

Missing the 1099 deadline can result in penalties and fines. The IRS may impose penalties of up to 270 per form for failure to file or furnish a 1099 form, with a maximum penalty of 3,339,000 for large businesses. Additionally, you may be subject to interest on any taxes owed due to the late filing of your 1099 forms.

How to File a 1099 Form

Filing a 1099 form is a relatively straightforward process. You can file 1099 forms electronically or by mail. To file electronically, you’ll need to use the IRS’s FIRE (Filing Information Returns Electronically) system. To file by mail, you’ll need to complete the 1099 form and mail it to the IRS address listed on the form.

It's essential to keep accurate records of your income and expenses throughout the year to ensure you're filing your 1099 forms correctly. Consider using accounting software or consulting with a tax professional to ensure you're meeting all the necessary requirements.

Tips for Meeting the 1099 Deadline

To ensure you meet the 1099 deadline, follow these tips:

- Keep accurate records of your income and expenses throughout the year.

- Set reminders for the deadline to ensure you don’t miss it.

- File your 1099 forms electronically to reduce errors and speed up processing.

- Consult with a tax professional if you’re unsure about any aspect of the filing process.

What is the deadline for filing 1099 forms for the 2024 tax year?

+The deadline for filing 1099 forms for the 2024 tax year is January 31, 2025.

Who needs to file a 1099 form?

+Freelancers, independent contractors, and small business owners who have earned income from various sources, such as freelance work, independent contracting, and self-employment, need to file a 1099 form.

What are the consequences of missing the 1099 deadline?

+Missing the 1099 deadline can result in penalties and fines, including up to $270 per form for failure to file or furnish a 1099 form, with a maximum penalty of $3,339,000 for large businesses.

In conclusion, meeting the 1099 deadline is crucial for freelancers, independent contractors, and small business owners. By understanding the requirements for filing 1099 forms and following the tips outlined in this article, you can ensure you’re meeting all the necessary obligations and avoiding any potential penalties. Remember to keep accurate records, file electronically, and consult with a tax professional if you’re unsure about any aspect of the filing process.