Code W On 1099 R

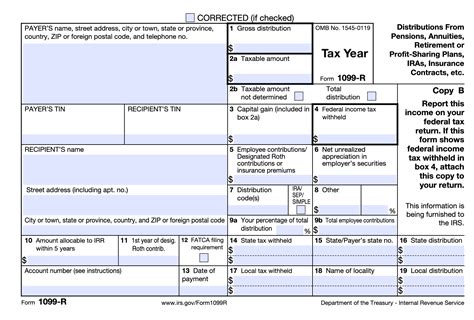

Distribution codes on a 1099-R form are used to indicate the type of distribution being reported, and Code W is one of these distribution codes. The 1099-R form, also known as the Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., is used by the payer to report distributions from these types of accounts to the recipient and to the IRS.

Code W specifically refers to “Reimbursement of Employee Business Expenses” under certain conditions. However, distribution codes on a 1099-R are more commonly related to retirement accounts or other qualified plans, and the relevance of Code W can vary based on the context and the specific plan from which the distribution is being made.

Understanding Distribution Codes on the 1099-R

Distribution codes are crucial for understanding the nature of the distribution. They are listed in Box 7 of the 1099-R form. Some common distribution codes include:

- 1: Early distribution, no known exception.

- 2: Early distribution, exception applies (under age 59 1⁄2).

- 3: Disability.

- 4: Death.

- 5: Prohibited transaction.

Code W, as mentioned, refers to reimbursements, but in the context of 1099-R, it is less commonly associated with retirement distributions and more with specific instances of reimbursements that might be considered distributions under the tax code.

Relevance of Code W

In general, distribution codes are critical for tax reporting purposes. They help the recipient and the IRS understand the nature of the distribution, which can impact how the distribution is taxed. For example, some distributions might be subject to an early withdrawal penalty, while others might be exempt based on the circumstances (e.g., disability or separation from service after age 55).

If you receive a 1099-R with Code W, it’s essential to consult the instructions for the 1099-R and potentially seek professional tax advice to understand the implications of this distribution code on your tax return. The applicability and implications of Code W can vary significantly depending on the source of the distribution and the specific circumstances surrounding it.

Action Steps

- Review the 1099-R Form: Carefully go through the form to understand the reported distribution and the distribution code.

- Consult Tax Professionals: Given the complexity of tax laws, especially regarding retirement distributions, consulting a tax professional or accountant can provide clarity on how to report the distribution on your tax return.

- Understand Tax Implications: Be aware of any potential taxes or penalties associated with the distribution. The tax implications can vary based on the distribution code and the recipient’s age, employment status, and other factors.

- Report Accurately: Ensure that you accurately report the distribution on your tax return. Inaccurate reporting can lead to delays in processing your return or even audits.

In conclusion, while Code W on a 1099-R might be less common than other distribution codes, understanding its implications is crucial for accurate tax reporting and compliance. Always consult professional tax advice when dealing with specific distribution codes or unusual circumstances to ensure you meet all tax obligations and take advantage of any exceptions or deductions you might be eligible for.

What does Code W on a 1099-R form indicate?

+Code W on a 1099-R form generally refers to reimbursement of employee business expenses under certain conditions. However, its application and implications can vary based on the context of the distribution.

How do I report a distribution with Code W on my tax return?

+Reporting a distribution with Code W involves accurately filling out your tax return to reflect the distribution as reported on the 1099-R. It’s advisable to consult tax professionals to ensure compliance with all tax obligations and to understand any potential tax implications or benefits.

Are distributions with Code W subject to taxes or penalties?

+The tax implications of a distribution with Code W can vary. While some distributions might be taxable, others may not, depending on the circumstances. Additionally, penalties might apply in certain situations, such as early withdrawals from retirement accounts without a qualifying exception. Professional tax advice can help clarify the specific tax implications.