Consumer Nmls Lookup Guide: Verify Licenses

Navigating the world of consumer finance can be a daunting task, especially when it comes to verifying the legitimacy of mortgage lenders and brokers. The National Mortgage Licensing System (NMLS) is a crucial tool in this process, providing a centralized registry for licensed mortgage professionals. In this comprehensive guide, we will explore the ins and outs of the NMLS consumer lookup, helping you understand how to verify licenses and make informed decisions when dealing with mortgage professionals.

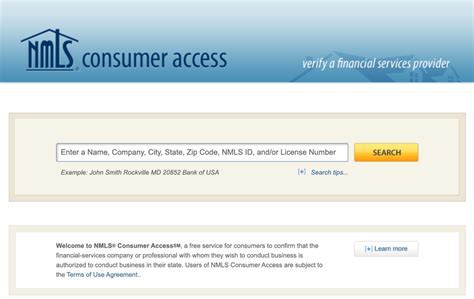

Understanding the NMLS Consumer Access Site

The NMLS Consumer Access site is designed to be user-friendly, allowing consumers to easily search for and verify the licensing status of mortgage companies, branches, and individuals. This publicly available resource provides detailed information about licensed entities, including their licensure status, business addresses, and disciplinary actions taken against them. To get started, simply visit the NMLS Consumer Access website and follow the prompts to begin your search.

How to Use the NMLS Consumer Lookup Tool

Using the NMLS consumer lookup tool is a straightforward process that requires minimal information. Here’s a step-by-step guide to help you get started:

Visit the NMLS Consumer Access Site: Begin by navigating to the NMLS Consumer Access website. This is where you’ll find the search tool for looking up licensed mortgage professionals.

Choose Your Search Criteria: You have the option to search by individual, company, or branch. Select the appropriate category based on who or what you’re trying to verify. For individuals, you might search by name or NMLS ID. For companies or branches, you can search by name or NMLS company ID.

Enter Your Search Terms: Input the necessary information into the search fields. Make sure to have the correct spelling of names or exact IDs to ensure accurate results.

Review the Search Results: Once you’ve entered your search criteria and initiated the search, the NMLS database will return a list of matching results. Click on the relevant entry to view detailed information about the individual or company.

Verify Licensing Status: The licensing status will be clearly indicated, showing whether the individual or company is currently licensed, inactive, or has been subject to any disciplinary actions. It’s crucial to ensure that any mortgage professional you work with has an active license in good standing.

Check for Disciplinary Actions: Part of verifying a license involves checking if there have been any disciplinary actions against the individual or company. This information can provide valuable insights into their professional conduct.

Importance of Verifying Licenses

Verifying the licenses of mortgage professionals is not just a step in due diligence; it’s a crucial protective measure for consumers. Here are a few reasons why:

Protection from Unlicensed Activity: Working with an unlicensed mortgage professional can expose you to significant risks, including fraud and unethical practices. Verification helps ensure you’re dealing with legitimate, regulated entities.

Regulatory Compliance: Licensed professionals are required to adhere to strict regulatory standards and ethical guidelines. Verifying a license helps ensure that you’re working with someone who is committed to these standards.

Consumer Confidence: Knowing that your mortgage professional is properly licensed can provide peace of mind. It’s an assurance that they have met the necessary educational, background, and testing requirements to operate in their field.

Common Mistakes to Avoid

While the NMLS consumer lookup is a powerful tool, there are a few common mistakes to be aware of:

Incorrect Information: Ensure that you have the correct name or NMLS ID for your search. Typos or incorrect information can lead to false negatives or incorrect results.

Assuming All Professionals Are Listed: Not all mortgage-related professionals require an NMLS license. For example, real estate agents or attorneys who provide mortgage advice but are not directly involved in lending activities may not be listed. Always clarify the role of the professional you’re working with.

Not Checking for Updates: Licensing status can change. It’s a good practice to periodically check the licensing status of your mortgage professional, especially if you’re in a long-term relationship or about to engage in a new transaction.

Conclusion

The NMLS consumer lookup is an indispensable resource for anyone navigating the complex world of mortgage finance. By understanding how to use this tool effectively, consumers can protect themselves from potential risks and ensure they’re working with licensed and reputable professionals. Remember, verification is an ongoing process, and staying informed is key to making the best decisions for your financial well-being.

FAQ Section

What is the purpose of the NMLS consumer lookup tool?

+The NMLS consumer lookup tool is designed to help consumers verify the licensure status of mortgage professionals, including individuals and companies. This ensures that consumers are working with licensed and reputable entities, protecting them from unlicensed activity and potential fraud.

How do I search for a mortgage company on the NMLS Consumer Access site?

+To search for a mortgage company, visit the NMLS Consumer Access website and select “Company” as your search criteria. You can then search by the company’s name or its NMLS ID. Ensure you have the correct spelling or ID to get accurate results.

Why is it important to verify the license of a mortgage professional?

+Verifying the license of a mortgage professional is crucial for protecting yourself from fraud and unethical practices. It ensures that the professional you’re working with is regulated, educated, and has met the necessary standards to operate in the field, providing you with a level of assurance and consumer protection.