Insurance Producer Number

The insurance producer number, also known as the National Producer Number (NPN), is a unique identifier assigned to insurance producers, such as agents and brokers, by the National Association of Insurance Commissioners (NAIC). This number is used to track and verify the licensure and appointment status of insurance producers across the United States.

What is the purpose of the insurance producer number?

The primary purpose of the insurance producer number is to provide a standardized way to identify and track insurance producers. This helps to ensure that only licensed and authorized individuals are selling insurance products, which in turn protects consumers from unscrupulous or unauthorized agents. The NPN is used by insurance companies, state regulatory agencies, and other industry stakeholders to verify the licensure and appointment status of insurance producers.

How is the insurance producer number assigned?

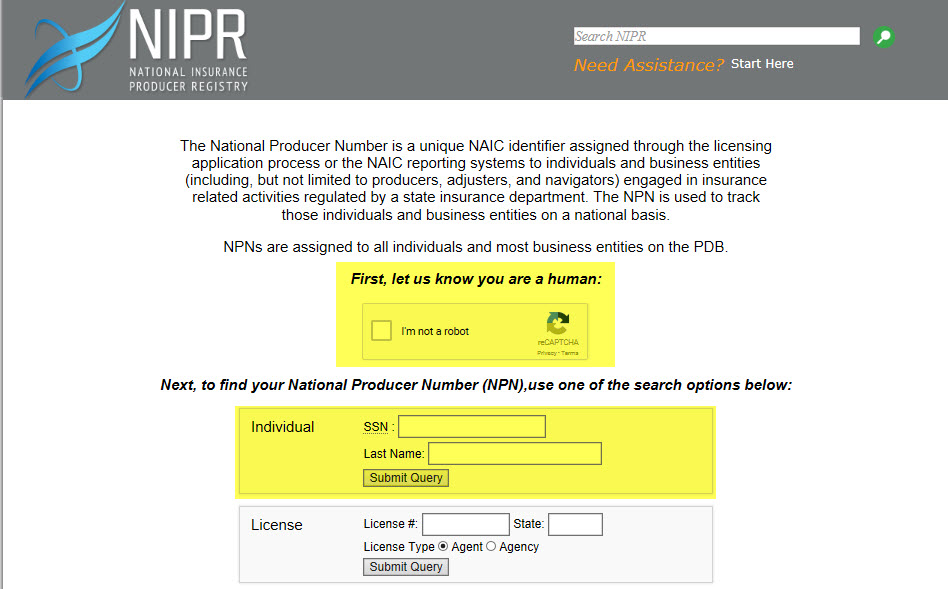

The insurance producer number is assigned by the NAIC through its National Insurance Producer Registry (NIPR). To obtain an NPN, an insurance producer must first become licensed by a state insurance department. The licensing process typically involves passing a series of exams, completing a background check, and paying licensure fees. Once licensed, the producer can apply for an NPN through the NIPR website.

What information is tied to the insurance producer number?

The insurance producer number is tied to a wealth of information about the insurance producer, including:

- Licensure status: The NPN is linked to the producer’s licensure status, including the type of license held, the state(s) in which they are licensed, and the date of licensure.

- Appointment status: The NPN is also linked to the producer’s appointment status, including the insurance companies they are appointed with and the dates of appointment.

- Continuing education records: Many states require insurance producers to complete continuing education courses to maintain their licensure. The NPN is tied to the producer’s continuing education records, which helps to ensure that they are meeting these requirements.

- Disciplinary history: If an insurance producer has been subject to disciplinary action, such as a fine or license suspension, this information is also tied to their NPN.

How is the insurance producer number used in practice?

The insurance producer number is used in a variety of ways in practice, including:

- Verification of licensure: Insurance companies, state regulatory agencies, and other industry stakeholders use the NPN to verify the licensure and appointment status of insurance producers.

- Compliance tracking: The NPN is used to track compliance with regulatory requirements, such as continuing education and licensure renewal.

- Marketing and sales: Insurance companies use the NPN to identify and track the sales activities of their appointed producers.

- Consumer protection: The NPN helps to protect consumers by ensuring that only licensed and authorized individuals are selling insurance products.

FAQs

What is the difference between an insurance producer number and a license number?

+The insurance producer number (NPN) is a unique identifier assigned to insurance producers, while a license number is a state-specific identifier assigned to a producer's license. The NPN is used nationally, while a license number is used at the state level.

How do I obtain an insurance producer number?

+To obtain an NPN, you must first become licensed by a state insurance department. You can then apply for an NPN through the NIPR website.

What is the National Insurance Producer Registry (NIPR)?

+The NIPR is a national database that tracks and verifies the licensure and appointment status of insurance producers. The NIPR is maintained by the NAIC and is used by insurance companies, state regulatory agencies, and other industry stakeholders.

In conclusion, the insurance producer number is a critical component of the insurance industry, providing a standardized way to identify and track insurance producers. By understanding the purpose, assignment, and use of the NPN, insurance professionals and consumers can better navigate the complex world of insurance regulation and sales.