Resale Certificate Guide: Tax Exemptions Made Easy

Understanding the intricacies of resale certificates and tax exemptions can be a daunting task, especially for businesses navigating the complex landscape of sales tax regulations. A resale certificate, also known as a reseller’s permit or sales tax exemption certificate, is a crucial document that allows businesses to purchase goods tax-free with the intention of reselling them. This guide aims to demystify the process of obtaining and using resale certificates, ensuring that businesses can take advantage of tax exemptions seamlessly.

What is a Resale Certificate?

A resale certificate is essentially a permit that lets businesses buy products without paying sales tax, provided they intend to resell those items. It’s a way for states to exempt businesses from paying taxes on goods that will eventually be sold to consumers, thereby avoiding double taxation. To qualify for a resale certificate, a business must have a legitimate resale purpose, meaning they plan to resell the goods, either in their original form or as part of a new product, without using them for personal or business consumption.

Benefits of Having a Resale Certificate

The primary benefit of holding a resale certificate is the ability to avoid paying sales taxes on purchases intended for resale. This can significantly reduce operational costs for businesses that buy and sell goods regularly. Moreover, having a resale certificate can streamline the purchasing process, as it clearly indicates to suppliers that the buyer is exempt from sales tax, reducing administrative burdens related to tax compliance.

How to Obtain a Resale Certificate

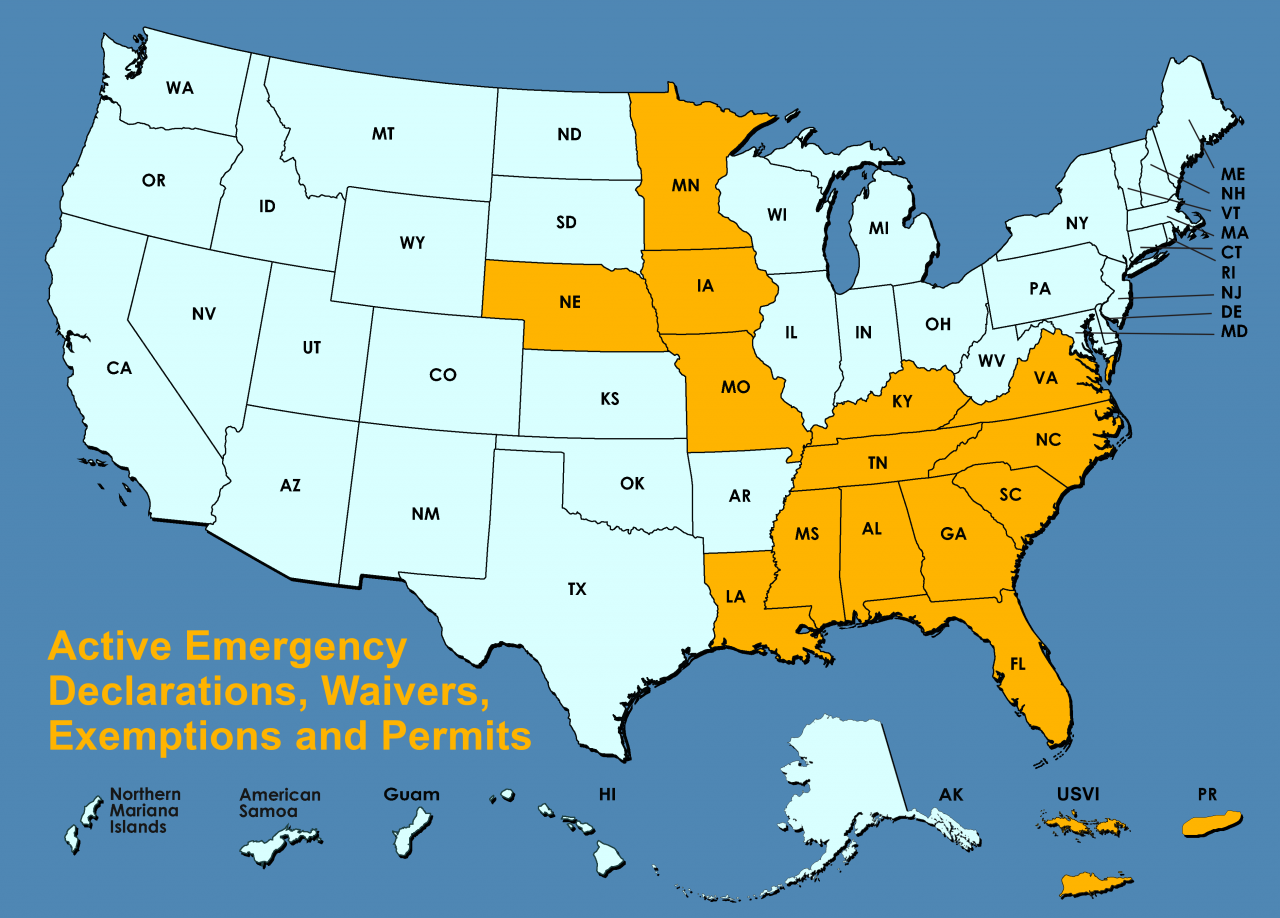

Obtaining a resale certificate involves several steps, which can vary depending on the state in which the business operates. Generally, the process includes: 1. Registering Your Business: Ensure your business is properly registered with the state and has all necessary licenses and permits. 2. Applying for a Sales Tax Permit: Most states require businesses to have a sales tax permit before issuing a resale certificate. 3. Filing for a Resale Certificate: Submit an application to the state’s taxing authority, usually providing details about your business, including its purpose, location, and the types of products you intend to resell. 4. Renewal: Resale certificates typically need to be renewed annually or biannually, depending on state regulations.

Using a Resale Certificate

When making a purchase with the intention of reselling the goods, businesses must provide the supplier with a copy of their resale certificate. This document must include the business’s name, address, resale certificate number, and a statement indicating that the purchase is for resale. It’s crucial to keep detailed records of all purchases made with a resale certificate, as well as the subsequent sales of those goods, to comply with auditing requirements and prove the exemption was legitimate.

Audits and Compliance

Businesses using resale certificates must be prepared for audits, which can be triggered by discrepancies in sales tax returns or random selections. During an audit, the business will need to demonstrate that all purchases made with a resale certificate were indeed resold and not used for personal or business consumption. Failure to comply with resale certificate regulations can result in hefty fines, including the repayment of sales taxes plus penalties and interest.

Future Trends in Resale Certificates

As e-commerce continues to grow, the landscape of resale certificates and sales tax exemptions is evolving. States are increasingly adopting new technologies and laws to simplify the process of obtaining and managing resale certificates, such as online application portals and automatic renewal systems. Moreover, the rise of dropshipping and third-party marketplace selling has introduced new complexities in determining resale eligibility, prompting states to reevaluate their regulations.

Decision Framework for Businesses

When deciding whether to obtain a resale certificate, businesses should consider the following factors: - Resale Intent: Do you genuinely intend to resell the goods without using them for personal or business purposes? - State Regulations: Are you familiar with your state’s specific requirements and regulations regarding resale certificates? - Administrative Burden: Are you prepared to manage the paperwork and potential audits associated with holding a resale certificate? - Cost Savings: Will the tax exemptions provided by a resale certificate significantly impact your business’s bottom line?

Myth vs. Reality: Common Misconceptions

- Myth: Resale certificates are only for large businesses.

- Reality: Businesses of all sizes can benefit from resale certificates, provided they meet the resale purpose criteria.

- Myth: Obtaining a resale certificate is overly complicated.

- Reality: While the process may vary by state, applying for a resale certificate is a standard procedure that many businesses navigate successfully.

- Myth: Resale certificates exempt all business purchases from sales tax.

- Reality: These certificates only apply to purchases intended for resale, not for goods used by the business itself.

Resource Guide

For businesses seeking more information on resale certificates and tax exemptions, the following resources are invaluable: - State Tax Authority Websites: Each state’s taxing authority website provides detailed information on how to apply for a resale certificate, renewal requirements, and compliance guidelines. - National Association of State Departments of Revenue: Offers comprehensive resources and guidance on sales tax regulations across different states. - Professional Tax Consulting Services: For complex situations or to ensure compliance, consulting with a tax professional can provide personalized advice tailored to your business needs.

FAQ Section

What is the primary purpose of a resale certificate?

+The primary purpose of a resale certificate is to allow businesses to purchase goods tax-free if they intend to resell those items, avoiding double taxation.

How often do resale certificates need to be renewed?

+The renewal period for resale certificates varies by state but is typically annual or biannual.

Can any business get a resale certificate?

+No, only businesses that intend to resell goods without using them for personal or business consumption can obtain a resale certificate.

In conclusion, navigating the world of resale certificates and sales tax exemptions requires a thorough understanding of state regulations, business intentions, and compliance requirements. By leveraging the information provided in this guide, businesses can make informed decisions about obtaining and utilizing resale certificates, ultimately streamlining their operations and optimizing their tax strategies.